Apple & Google Subscriptions: Is the Higher Commission Worth It?

When you’re trying to build an app with a sustainable business model, one of the most important decisions that you have to make surrounds the payment method that you select. This can make or break your chances of success and have a significant impact on the scale that you can achieve.

In this article, we’re going to explore the different payment methods available and how you can select the best one for your particular situation.

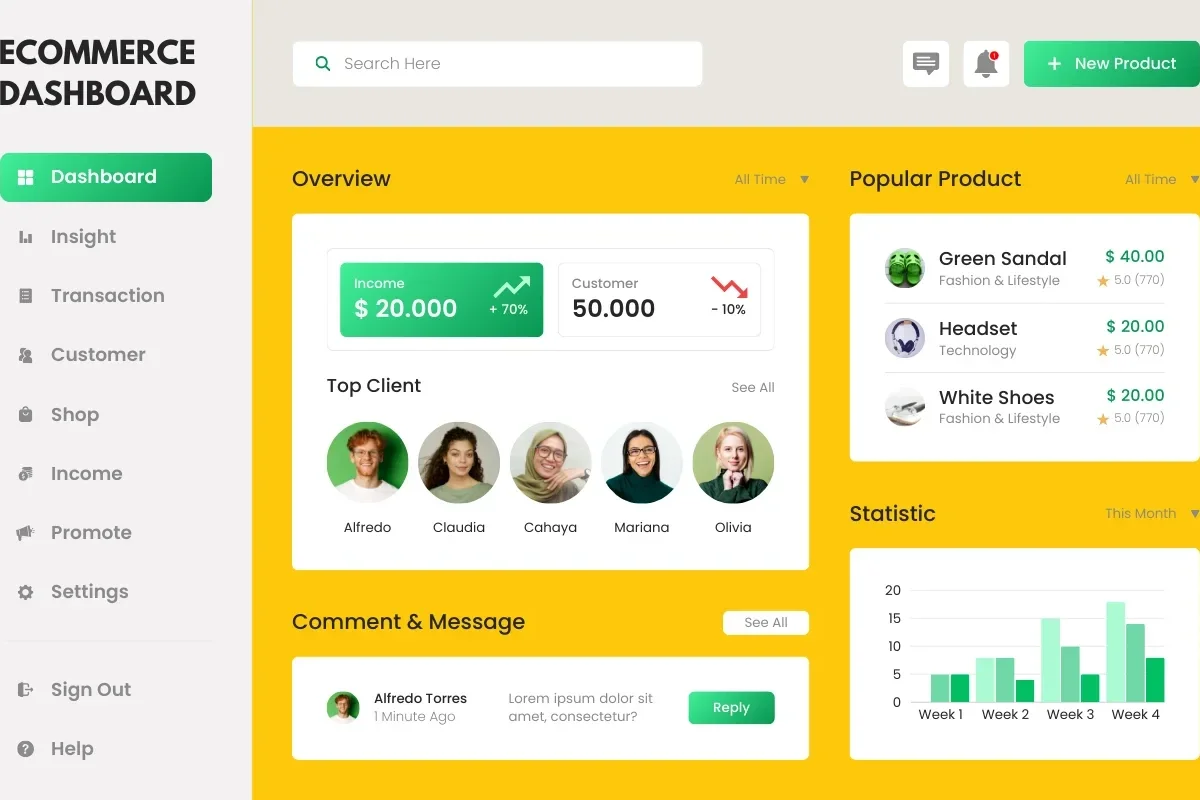

What Payment Options are Available?

Let’s start by laying out the current ecosystem so we know what our most common choices are:

- Apple App Store. Apple takes a commission of 30% on all payments processed through their ecosystem – making them the most expensive option. However, many of our clients negotiated at the rate of a 15% commission

- Google Play Store. Google will charge 9-10% of all payments processed, depending on the nature of the app and other criteria.

- PayPal. Accepting payments through PayPal will cost you 2.9% of the transaction plus a flat $0.30 on each transaction.

- Stripe. This is very similar to PayPal, charging 2.9% and a flat $0.30 per transaction.

The natural question is whether the higher prices are worth it? And this can only be answered when we take into account the other factors that play a role in a sustainable and compelling proposition for your customers.

How Do Payments Work for Mobile Apps?

When designing your payment process, you also need to choose between a variety of different payment models that will determine how your users get charged for the mobile app they are using. Here are some of the more common ways this happens:

- Subscriptions. The most common way that users pay is via a subscription. This is when a user pays regularly on a weekly, monthly, or annual basis for the usage of the app. Typically, the payment processor will store the credit card details associated with that account and the transaction will go off automatically. This auto-renewal reduces friction and helps you to maintain more recurring revenue over time.

- Once-Off Payments. Users can also buy your app outright by making a once-off payment. This is great for apps with a single value proposition where the customer doesn’t expect continual development and improvement.

- Coupons. Another way that apps can work is by using coupons. Companies can seed the marketplace with coupon codes that are obtained elsewhere – which can then be redeemed in-app. This can be useful in various situations where the transaction is not a direct one necessarily.

All of these methods can be achieved through any payment processor but some are better suited than others. The iOS and Android ecosystems are built for the subscription model because they have all the customer’s payment information on file – making it easier for them to buy the app without friction. Stripe, PayPal, and others don’t have as strong a relationship with the users and therefore are better suited for one-off transactions.

How Should I Decide Which Payment Model to Use?

Choosing the right payment model for you is going to depend on the category of app that you’re developing. Let’s look at how different categories affect the suitable payment model:

- Entertainment Apps. Apps like Netflix which rely on constant updates and additions to the catalog best suit subscriptions which can be done across any of the different gateways.

- Productivity Apps. If your productivity app is going to get consistent updates then a subscription might be best, but if it’s simply a utility that will remain the same – it’s probably better to do once-off payments which can be done through any gateway.

- Utility Apps. These are typically once-off purchases because they have a singular and well-understood value proposition. Stripe, PayPal, and the like can be a good option here.

- Gaming Apps. Games often use in-app purchases which are better suited to existing ecosystems like iOS and Android – because there is much less friction in the moment.

- Education Apps. Assuming that your curriculum and resources are going to be changing over time, subscriptions are often a good option here – even if they have a finite end date to align with examinations or something similar.

This list is not exhaustive but it gives you a sense of how the categories affect which payment method you should be considering.

How Should I Think About Merchant Accounts?

When you stay outside the iOS and Android ecosystems, you’ll need to consider how to access a merchant account. If you don’t have one yet, your best option would be to use a gateway that creates one automatically for you upon registration (like Stripe or PayPal). It’s worth noting that you do pay quite a high commission here which can be painful if you’re a merchant with a large customer base and high product turnover.

If you’re launching a large marketplace with lots of daily transactions, it’s probably more cost-effective to choose a gateway that doesn’t have an attached bank account. You’d have to obtain your own one, but it would reduce your cost. Some of the most popular options here are SagePay and PayPoint. You’ll need to spend some time and effort configuring these – but you’ll save on the high commissions you would have paid someone to do it for you.

So, Who Do I Choose?

Essentially, after taking everything above into account – here is how we think about it:

Going with Apple or Google makes a lot of sense if you want to minimize friction for your customers and keep your conversion rates high. Their one-click payment functionality is simple and well-understood, and you can benefit from their large existing audience. However, you will pay a significant fee for this – so it needs to be worth it for you. Identify where your target audience is and assess which one is best for you.

For payments that are less impulsive and more considered, Stripe or PayPal can be good options. They are slightly slower than app stores, but they give you more control and better profitability on a per-app basis. You’ll need to have the existing audience already to reach scale with these options.

All in all, it depends on a variety of factors that are unique to your situation. Here at Sunflower Lab, we’ve worked with many different app developers over time and we’d love to help you make the right decision. So, don’t hesitate to get in touch – we’d love to hear from you.

Get a Free Quote On your Project today!

Your idea is 100% protected by our Non-Disclosure Agreement

Related Posts

How Automating Accounts Payable can Improve Business Productivity?

AI & RPA to automate invoices that can deliver a fast & efficient Account payable workflow solution, allowing faster payments in lesser…

Enrich Employee Onboarding Process with Automated Email Data Extraction and Entry

When a new employee joins an organization, the Human Resources department must gather several different types of information from them.

Return 15% of Workday Back To Employees by Automating Patient Letter Process

Employee expense receipt management is the perfect process for RPA because it is logic based and redundant. Let’s look at an example.

You might also like

Stay ahead in tech with Sunflower Lab’s curated blogs, sorted by technology type. From AI to Digital Products, explore cutting-edge developments in our insightful, categorized collection. Dive in and stay informed about the ever-evolving digital landscape with Sunflower Lab.