RPA for finance and accounting is growing in popularity as more organizations are realizing the cost, time, and effort benefit of implementing process automation into their workflows. This is because of the repetitive, rule-based nature of these departments. Data entry, simple calculations, reporting—these tasks are so easy even a software robot can do it, and we’re going to show you how!

The Problem with Manual Finance and Accounting Processes

The finance and accounting department is critical to the everyday operations of an organization. Chief Financial Officers are under constant pressure to optimize their department’s output. And yet, finance and accounting workflows are riddled with countless boring, objective tasks that hinder the department’s operations. Knowledge workers—who are capable of much more challenging duties—are stuck with humdrum activities. Errors, delays, inefficiency, and burnout are just a few symptoms of a manually-managed finance and accounting department. Robotic process automation (RPA) has been a key driver of innovation in finance and accounting departments, delivering a host of benefits including cost savings, accuracy, scalability, and better compliance.

Process Automation for Finance and Accounting Departments

Finance and accounting departments around the world are implementing RPA into their workflows. Robotic process automation is the use of software bots to eliminate employee’s tedious, repetitive tasks so they can focus on more valuable work. RPA software bots are onboarded to “learn” and then take over the mundane and repetitive tasks carried out by humans. In turn, this frees up the humans to perform more high-value duties. Robotic process automation can be added as an additional layer on top of existing infrastructures and applications. RPA can be implemented at an individual level or an organizational level (click here for more on RPA adoption strategies).

A step-by-step process module for the task to be automated is prepared by the managing individual. The actions specified in the process module can range from understanding what’s on a screen, completing the right keystrokes, navigating systems, identifying and extract data. In a finance and accounting department, these actions include data entry, calculations, and other duties commonly found in finance and accounting workflows. Let’s get into some more specific RPA use cases for finance and accounting.

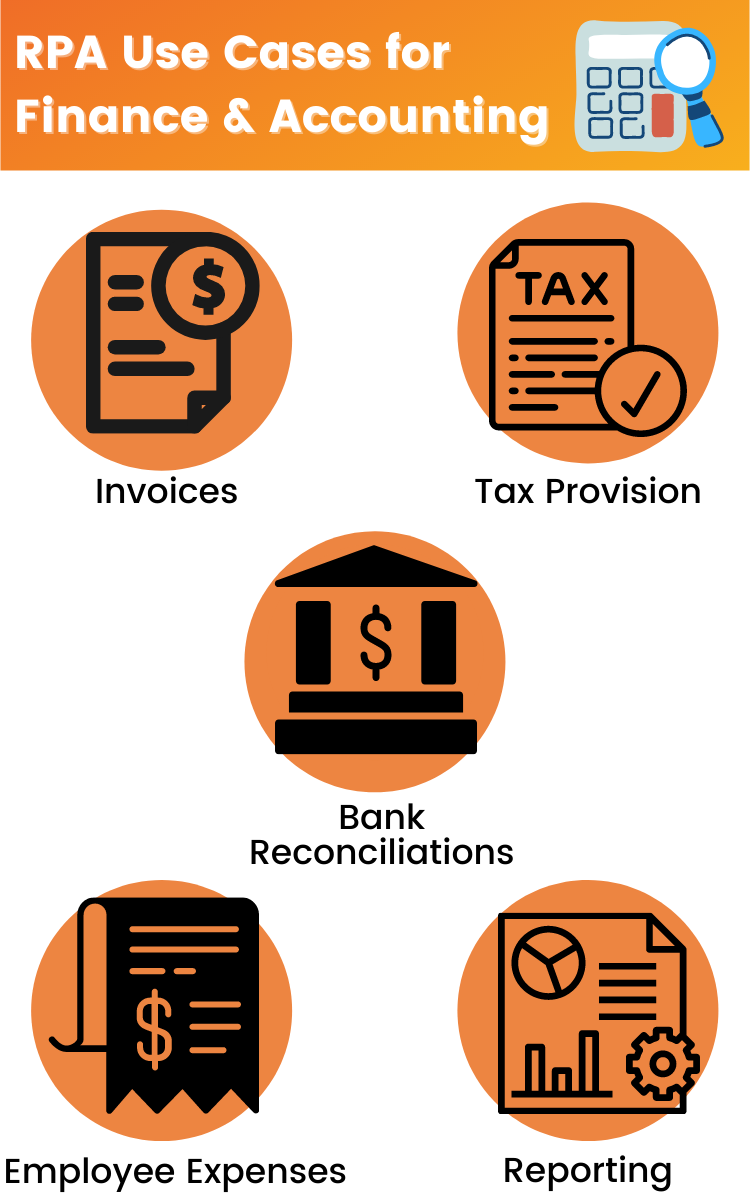

RPA Use Cases for Finance and Accounting

Robotic process automation can be applied to several different areas of a finance and accounting departments, including invoice processing, bank reconciliations, tax provisions, reporting, and employee expense receipts.

RPA for Invoice Processing Automation

Handling invoices is one of the most monotonous, time-consuming, error-prone, costly activity in the finance and accounting department. All of these characteristics make it the perfect candidate for automation. RPA software robots are able to constantly monitor a dedicated folder where invoices sent. The invoice PDF attachments are downloaded and saved in a folder. Using optical character recognition (OCR) and natural language processing (NLP) capabilities, software robots can read and extract key info from each invoice. That information is then inputted into the company’s data base or ERP system. For invoices with business exceptions, like a past due date, the bot automatically sends an email to the managing knowledge worker with the affected invoice attached. At the end of the process, RPA sends a final report to the knowledge worker. RPA will help F&A professionals by ensuring invoices are processed accurately, quickly, and on-time. Check out this article on automating invoice processing to learn more.

RPA for Bank Reconciliations

Managing different account types, institutions, payment times, and time zones makes bank reconciliation a huge hurdle for knowledge workers in the finance and accounting department. Rather than manually toggling between journals to match transactions, RPA can do it for you. Software bots can upload all the statements that they receive in paper, PDF, and excel formats onto a cloud-based statement processing system. Then a comparison is run to match payment details with bank records. All matching information is reconciled. If there are discrepancies in the data, like missing info or duplicates, RPA sends back the ledgers to the accounts payable team to investigate further.

Tax Provision Automation

Corporate F&A departments are responsible for setting aside capital in order to cover tax provisions. Manually calculating these estimates is quite cumbersome for knowledge workers. Nevertheless, the IRS will expect accurate expenditure each year. RPA can help improve this process. To begin the process, RPA bots connect to data source to create and export the trial balance data. Bots can cleanse the data against tax rules to make sure all compliances are met. Then, the bot can utilize visualization tools to showcase the forecasted tax provisions.

Financial Reporting Automation

Reporting and forecasting is critical aspect of the finance and accounting department. Major decisions are based off the past performance and future projections of the company’s financial health, so there is no room for error. Process automation can be utilized to enter queries in your data and analytics applications, extract data, save in a report, and send for your review. Bots can also be programmed to continually run analysis so you can constantly stay abreast of all the ongoing latest capital expenditures, investments, and financial statements.

Employee Expense Receipts

Automating the employee expense receipts can significantly improve the time, expense, and accuracy of the manual workflow. RPA bots will receive employee expense receipts via email, download the attachments, create a folder with the employee’s name, and save all the attachments in the corresponding employee’s folder. For an in-depth example, check out this article on automating your employee expense receipts, or watch the video below.

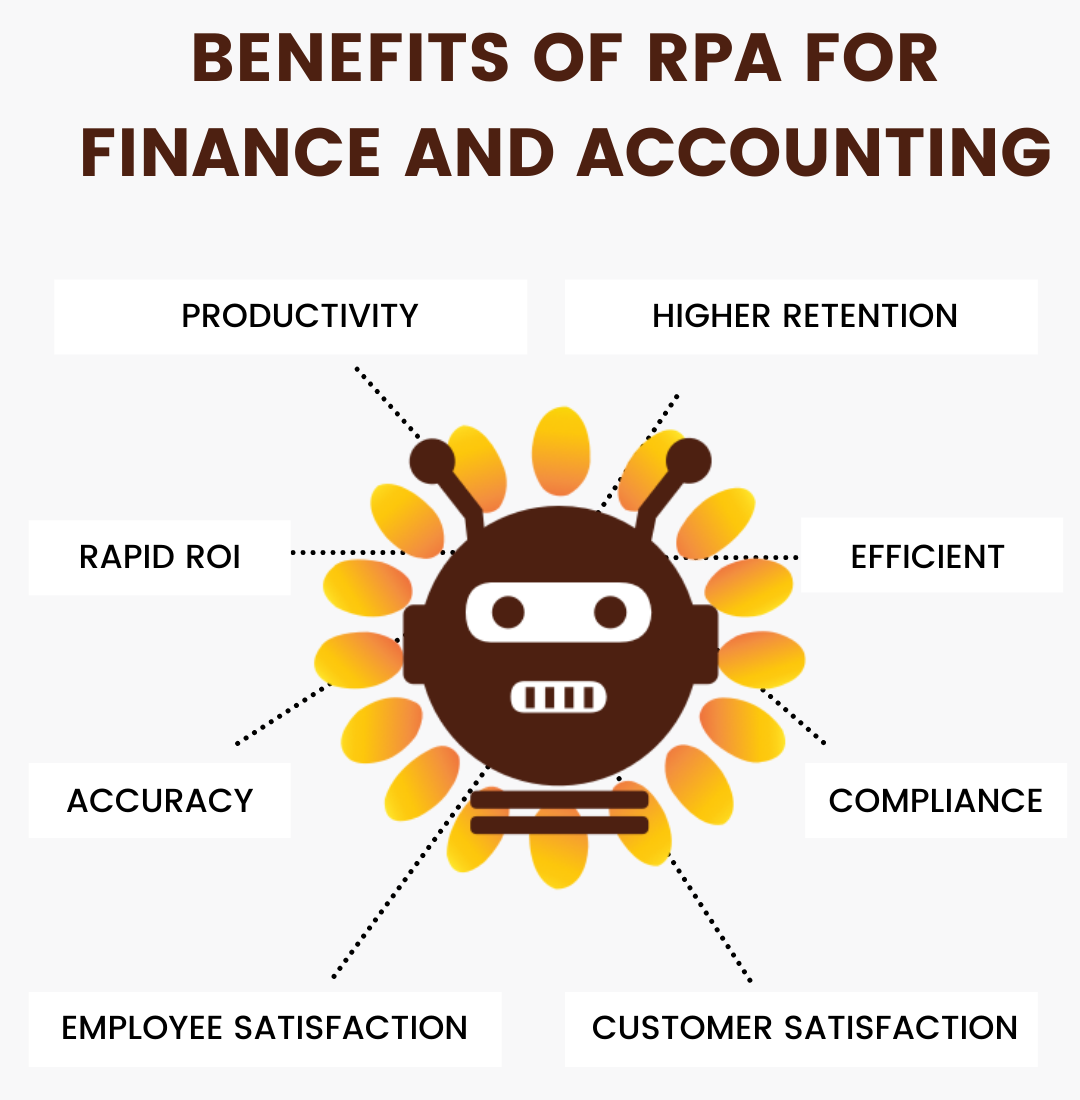

Benefits of RPA for Human Resources

Leveraging the emerging tech concept of robotic process automation will help finance and accounting departments work smarter not harder in several ways: higher employee and customer satisfaction, more productivity, fewer errors, higher retention rates, rapid ROI, scalability, and better compliancy to name a few. While the RPA bot works around the clock to complete the administrative, logic-based jobs without error, knowledge can pursue more interesting an interactive work. This will mitigate burnout and raise their satisfaction levels. RPA for HR will also delight new and existing employees as they are getting more attention from their human resource colleagues. RPA system can be scaled quickly and easily when the workload spikes, all the while keeping perfect compliancy. Last but certainly not least, The Institute for RPA estimates that process automation solutions can deliver an immediate savings of 25% to 40% in labor costs alone. McKinsey Digital also found that automating business processes can result in an ROI of between 30 and 200 percent in the first year. These are just a few of the sprawling list of benefits of RPA for human resources.

Higher employee satisfaction

New and existing employees receive more attention from HR representatives, meaning more of their needs are being met.

Knowledge workers are more fulfilled

Boring work is replaced with more interesting and in-person work which reduces quit rates.

Higher retention rates

With more satisfied HR specialists and employees, fewer individuals will seek alternative employment.

Higher productivity

RPA bots can complete tasks 24/7 while knowledge workers can add value to the company elsewhere.

Higher Accuracy

Human error is the cause of many HR discrepancies. As long as they are programmed correctly, software bots can deliver error-free workflows.

Scalability

RPA system can be quickly scaled to handle large volumes of data when the workload spikes.

Higher Compliance

Software bots can be programmed to follow required compliances with 100% accuracy.

Cost Savings

ROI for RPA is a major driving factor for adopting automation.

Elevating Finance and Accounting with Process Automation

The future is automated, but finance and accounting departments are stuck in the past. Now, robotic process automation is being introduced to help alleviate knowledge workers of repetitive, boring tasks. From payroll to employee training, RPA is helping HR sectors put their focus back on their workforce by automating these boring jobs. As a result, companies are realizing higher retention rates, more satisfaction, better accuracy, and more. Together, knowledge employees and digital workers can collaborate for a truly efficient and powerful workforce. Gartner reports 80% of finance leaders have implemented or are planning to implement RPA. Will you be among them?

You might also like

Stay ahead in tech with Sunflower Lab’s curated blogs, sorted by technology type. From AI to Digital Products, explore cutting-edge developments in our insightful, categorized collection. Dive in and stay informed about the ever-evolving digital landscape with Sunflower Lab.