Managing insurance verification in hospitals, where a large number of patients visit daily, can be a time-consuming challenge. Recognizing this, our insurance verification service employs an innovative middleware bot to streamline the process. This intelligent bot seamlessly extracts data from the hospital’s system and transfers it to the insurance provider’s system for verification. Once verified, the relevant information is smoothly integrated back into the hospital’s system.

By automating this journey, our solution not only reduces delays but also enhances accuracy, allowing hospital staff to devote more time and attention to critical tasks and patient care. This streamlined approach ensures a more efficient and hassle-free insurance verification process for healthcare providers.

What Is Health Insurance Eligibility Verification?

Insurance eligibility verification is a process that checks a patient’s coverage and eligibility before providing services. Healthcare providers carry out the process so that patients are insured and that the services they are providing are covered under the plan. In determining the eligibility of an insurance claim an insurance representative will collect insurance data and verify that it is true and accurate. Providers can carry out this process manually through contacting their insurance company, or through a digital system confirming insurance eligibility.

Why do you need to Automate your VOB Process?

Automating the Verification of Benefits (VOB) process is crucial for healthcare and insurance providers, as relying on manual procedures can lead to inefficiencies and concerns for both staff and patients. The traditional manual approach often results in a lack of transparency, leaving healthcare providers uncertain about reimbursement and patients anxious about potential financial burdens associated with medical procedures.

By introducing our Insurance Eligibility Verification Automation services, we aim to streamline and enhance the entire revenue management process. Automation allows for the prior authorization of medical bills, providing a more efficient and error-free VOB process. This not only reduces the burden on staff but also ensures that patients have clear and accurate information regarding their insurance coverage.

Automating your workflows will not only help you to redirect your focus towards strategic tasks, but lead to improved resource planning, cost-cutting measures, and timely checkups and more.

3 Ways in which VOB Process can be Automated

To perform the insurance verification process, we use robust and secure methods like Power Automate Cloud and Power Automate Desktop Flow. Power Automate, previously known as Microsoft Flow, is a SaaS platform used to automate different processes. We use Power Automate AI Builder for Bot creation and train it to fulfill all your business needs. AI Builder allows us to easily integrate artificial intelligence into apps and workflows without needing extensive programming knowledge. It offers pre-built models and a simple interface to automate tasks, analyze data, and make predictions. Here, text classification is performed by AI Builder to extract information from documents.

Using Power Automate not only seamlessly automates the whole VOB process but it also decreases the delivery time for an application. There are several other tools and platforms available that we can explore based on your specific needs and requirements like UiPath, Automation Anywhere, etc.

1. Power Automate Cloud

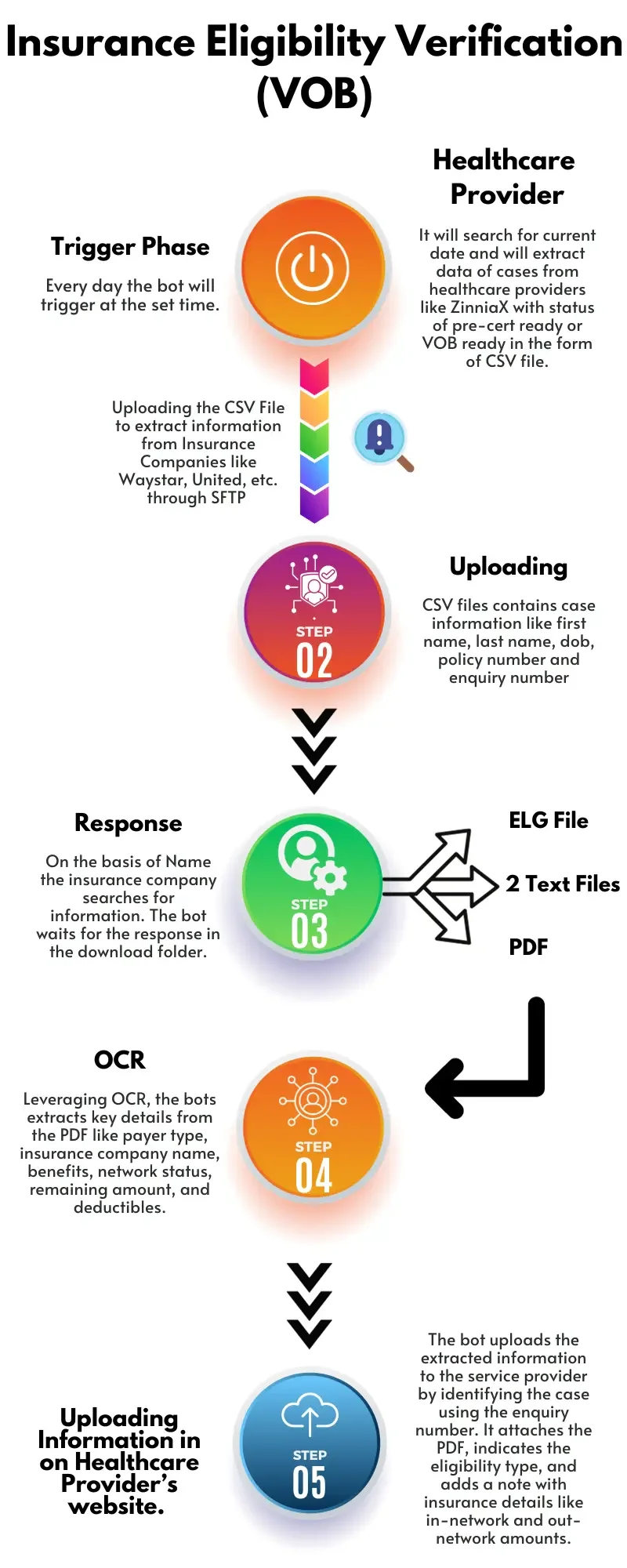

Every healthcare service provider deals with loads of documents and faces difficulty in connecting with 3rd party services. To solve this issue, we have brought the Power Automate Cloud method which can simplify the process of extracting patient’s insurance details from the insurance company.

This process can be carried out by calling APIs from healthcare service providers like ZinniaX, Baker Tilly, etc. and extracting cases with a status of “VOB Ready” or “Pre-cert Ready” for the current date. The information is received in a CSV file format with details such as first name, last name, policy number, date of birth, and enquiry number.

The pre-trained bot initiates here by uploading this file in the location provided by the insurance providing company like Waystar, United, etc. The files might be transferred to a data server like SharePoint, AWS S3, etc. from where the Insurance company collects it, uploads on their website. This information is visible in the Eligibility Criteria Batch on their website. They then provide a response once again in the data server with a PDF file, two text files and one ELG file, which contains additional patient information. This process is performed through a protocol known as Secure File Transfer Protocol (SFTP).

Leveraging OCR, the bot extracts key details from the PDF, such as payer type, insurance company name, benefits, network status, remaining amount, and deductibles. This extracted information, then, is once again uploaded in healthcare service providers database through API calls by identifying the patient through their enquiry number, attaching the PDF, indicating the eligibility type, and adding a note with comprehensive insurance details like in-network and out-network amounts.

Note: The API calls can be performed between the storage location and the Insurance Providing Company as well based on their requirements and security concerns.

2. Power Automate Desktop Flow

The second option is to create a desktop flow, where we will train the bot to manually login onto ZinniaX’s website, but with limited access only for security reasons. The bot, just like in Cloud method, will search for cases with a status of “VOB Ready” or “Pre-cert Ready” for the current date and extract information in CSV format.

It uploads the CSV file with the same information to the upload folder in insurance providing companies through SFTP or at another location like SharePoint or AWS Bucket, which will then be visible in the Eligibility criteria batch of their websites. The bot lacks access to the insurance company’s website as well, which keeps the data secure and safe. After, the bot awaits a response in the download folder (in case of SFTP), comprising a PDF file, two text files, and one ELG file, which contains additional patient information.

It will then follow the same procedure of extracting data from the PDF using OCR technology. The information extracted like deductibles, in network amount, out network amount, and remaining amount will be added again in the cases by searching them using the enquiry numbers. This whole process will be completed by bot without humans intervening in between and utilizing their time for more essential tasks.

Note: A bot can be created between the storage location and the Insurance Providing Company as well to collect the data and provide a response based on their requirements and security concerns.

3. Are API Calls Secure?

In benefits verification, API calls are essential for retrieving information from external systems, like insurance providers or government agencies. This makes the process simple, fast and easy for both the Healthcare and Insurance Providing Companies.

But it is also a big fear of the companies that their data might get stolen from databases through APIs. It is important for API calls to have proper authorization which happens in the following way.

After integration and authentication, the requesting system (in this case our bot) sends a structured API request with relevant details. The external system (the healthcare service provider) processes this request, verifies the data, and sends back a response. The requesting system extracts and incorporates the information, with error handling in place for issues. APIs streamline the benefits verification process, automating tasks and ensuring accurate eligibility data retrieval.

Recognizing the sensitivity of sharing API credentials, companies can enhance data security through OAuth 1.0 or 2.0, token-based authentication or any other authentication method which their API allows. We can implement webhooks for data notifications and ensure strong encryption and access controls. These measures offer secure alternatives for data access without compromising sensitive information, providing a balanced approach to benefits verification and other processes.

Innovating Healthcare Industry

Simplify Your Healthcare Requirements for Insurance Verification Process with our VOB Solutions!

Know your ROI

50%

Cost Reduction

70%

Resource Allocation

70%-90%

Quick Verification & Response Time

100%

Regularized data all in one place

Understanding your ROI is crucial, but it goes beyond knowing what you’re investing in; it’s about understanding the impact of that investment. Automation and Artificial Intelligence (AI) stand out as technologies with the potential to significantly enhance ROI across various workflows.

Insurance verification helps healthcare providers in the following ways

Insurance verification can improve billing processes and prove the insurance patient’s health status, while avoiding administrative difficulties. Businesses must adhere to national or state legislation to provide services and programs to improve the quality of medical services.

1. Reduced Claim Denials

By verifying patients’ insurance eligibility and coverage details in advance, healthcare providers can significantly reduce the risk of claim denials. This ensures that the services provided are covered by the patient’s insurance plan, minimizing financial losses and administrative burdens associated with denied claims.

2. Improved Revenue Cycle Management

Insurance verification is a crucial component of the revenue cycle management process. It helps providers accurately assess a patient’s financial responsibility, including co-pays, deductibles, and co-insurance. This upfront clarity aids in more accurate billing and collections, ultimately improving the financial health of the healthcare facility.

3. Enhanced Front-End Efficiency

Verifying insurance information at the front end of the patient encounter streamlines the registration process. This leads to faster check-ins, reduced wait times, and improved overall efficiency in the healthcare facility. Patients appreciate a smoother and more organized experience.

4. Optimized Staff Productivity

Automation of insurance verification processes or utilizing specialized software allows healthcare staff to focus on patient care rather than spending excessive time on manual data entry or dealing with claim denials. This optimization of staff productivity contributes to a more patient-centered approach.

5. Accurate Eligibility Checks

Insurance verification ensures that healthcare providers have access to accurate and up-to-date information about a patient’s insurance coverage. This includes details such as coverage start and end dates, in-network providers, and any pre-authorization requirements, enabling providers to deliver appropriate and covered services.

Reason for Claim Denials in Insurance Eligibility Verification Process

Claim denials in the insurance eligibility verification process can occur for various reasons. Understanding these reasons is crucial for healthcare providers to address issues early in the revenue cycle management process. Here are common reasons for claim denials:

1. Incorrect Patient Information

Inaccurate or incomplete patient details, such as name, date of birth, or policy number, can lead to claim denials. It’s essential to verify and update patient information regularly.

2. Expired Insurance Coverage

If a patient’s insurance coverage has expired or is inactive on the date of service, claims may be denied. Regular eligibility checks can help identify coverage status changes.

3. Ineligible Services

Some insurance plans may not cover specific services or procedures. Claims for non-covered services will be denied. Verifying the coverage details for the specific service is crucial.

4. Out-of-Network Providers

If a healthcare provider is not in the network specified by the patient’s insurance plan, claims may be denied or processed at a reduced rate. It’s vital to confirm network status before providing services.

5. Authorization Requirements

Certain medical procedures may require pre-authorization from the insurance provider. Failing to obtain the necessary authorizations can result in claim denials.

6. Coordination of Benefits Issues

In cases where a patient has multiple insurance policies, coordination of benefits issues can arise. If primary and secondary insurance information is not accurately reported, claims may be denied.

7. Billing Errors

Errors in the submission of claims, such as incorrect codes or incomplete information, can lead to denials. Regular training and auditing can help reduce billing errors.

8. Duplicate Claims

Submitting duplicate claims for the same service can result in denials. It’s essential to maintain proper billing practices and avoid duplicate submissions.

9. Timely Filing Limitations

Insurance companies often impose deadlines for submitting claims. Failing to submit claims within the specified time frame can lead to denials.

10. Policy Termination

If an insurance policy is terminated, any claims submitted after the termination date will likely be denied. Regularly checking the status of insurance policies is crucial.

Conclusion

Make your Insurance Eligibility Verification easier with Sunflower Lab’s VOB Services. Do not let healthcare workflows become a burden on your employees, rather create flows that make it simple and allow you to focus on customer satisfaction.

Partner with Sunflower Lab and turn your dreams into reality. Contact Us today and our team will be happy to assist you further.

Our Automation Solutions

Drive Success with Our Tech Expertise

Unlock the potential of your business with our range of tech solutions. From RPA to data analytics and AI/ML services, we offer tailored expertise to drive success. Explore innovation, optimize efficiency, and shape the future of your business. Connect with us today and take the first step towards transformative growth.

You might also like

Stay ahead in tech with Sunflower Lab’s curated blogs, sorted by technology type. From AI to Digital Products, explore cutting-edge developments in our insightful, categorized collection. Dive in and stay informed about the ever-evolving digital landscape with Sunflower Lab.