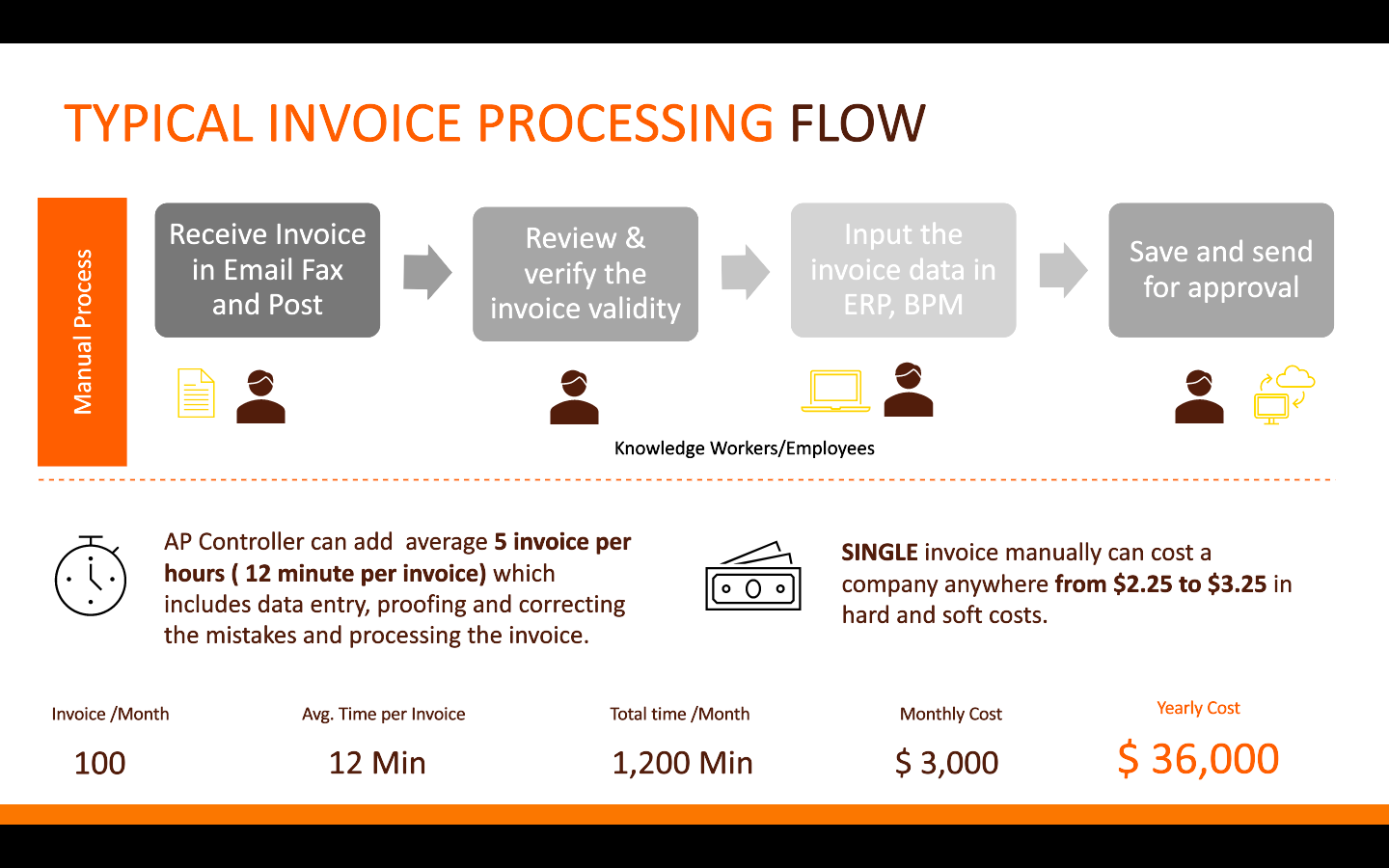

Accounts Payable Workflow poses a big challenge to any business, especially if you’re transitioning from a small to medium level business. It is a very important area of the financial department and can either make or break a company. This process was executed manually which wasted a lot of valuable time of companies until the era of AI & RPA came along.

The Problem with Paper

Businesses of all shapes and sizes waste valuable time and energy every day by managing their invoices by hand. Due to the challenges of Traditional Paper-based Processes the accounts payable department is bloated with the manual process of:

- Entering invoice data

- Creating paper invoices

- Matching purchase orders

- Endlessly Filing

To complete a single invoice, AP controllers must toggle back and forth between their email and invoice preparation application, be it Oracle NetSuite, Wave, QuickBooks, Tipalti, Xero, SAP, Microsoft Dynamics, ERPNext, Odoo, GunCash, TurboCASH, Sage Inacct, or other ERP softwares.

This might lead to you losing your vendor or receiving your orders late because these processes are:

- Time consuming

- Riddled with human error

This leads to costly consequences and more delays in the payment processing.

Challenges Associated with Manual Invoice Handling

- Receiving Invoices in different Structures and Formats.

AP department always has to figure out what section is for what. Figuring this out burns up a lot of time of AP department which they can spend by focusing on more priority tasks.

- Keeping Payment Records

Did you or did you not pay for any particular purchase? Humans tend to make mistakes, unlike machines, which are capable of keeping records of everything. This strikes out the issue of double payments and for late/delayed payment charges as well.

Solution

Robotic process automation can rescue your employees from boring tasks, save your company from expensive mistakes, and deliver a fast and efficient workflow solution to your organization.

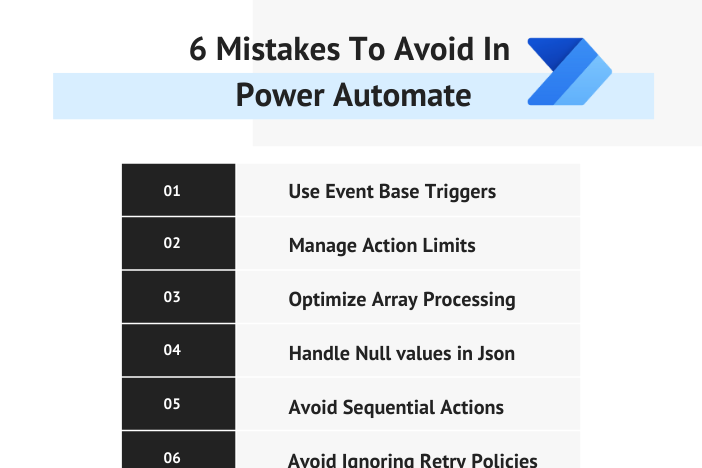

Invoice processing is the perfect candidate for RPA because it is boring, repetitive, and rule-based. Software bots can be easily programmed using Power Automate to process:

- Invoice data entry

- Validate information

- Create business exceptions

- Send invoices

- Generate summary reports after finishing the job — all automatically.

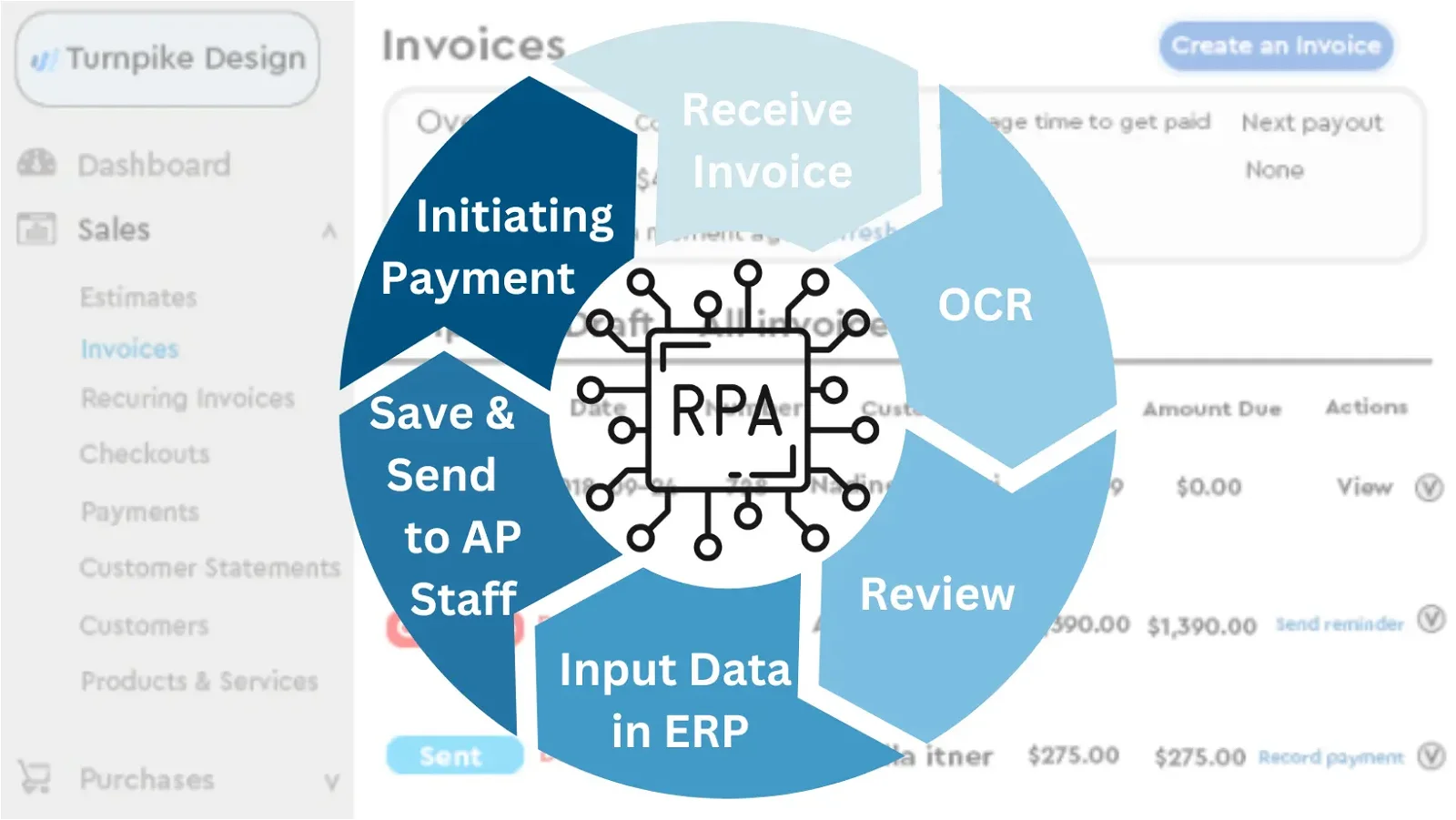

Here’s an example of how it works using Wave Invoices as the AP application:

We used Wave in the example above, but no matter what AP application you use, RPA can be implemented to automate your specific accounts payable workflow.

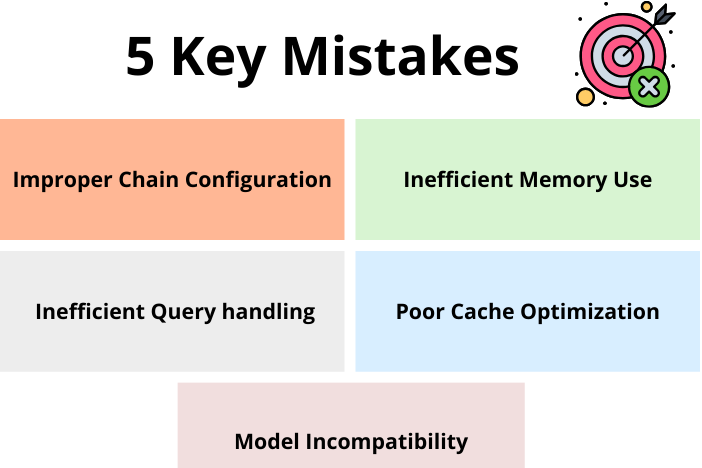

RPA is an excellent choice for automating invoice processing when dealing with a consistent format. However, handling invoices with multiple formats can be challenging as it requires manual intervention to ensure proper separation and processing.

Some businesses initially adopt RPA for invoice automation but face difficulties when dealing with format changes, leading to resource wastage. RPA is limited to rule-based tasks and may require human intervention for even minor format variations.

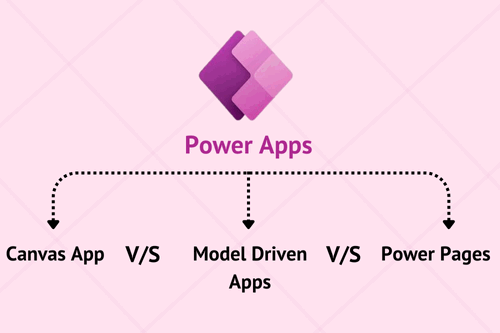

To address the structured aspects of invoice processing and handle diverse invoice formats, we use Power Automate with Artificial Intelligence (AI) which is beneficial solution for buisnesses. AI and Machine Learning (ML) technologies can enhance automation capabilities significantly.

Optical Character Recognition (OCR) and Named Entity Recognition (NER) enables the system to scan, convert, and analyze invoices in various formats, irrespective of the vendor’s Enterprise Resource Planning (ERP) systems. It extracts precise information from invoices, such as text, images, and characters, and accurately places them into the corresponding fields.

This enables efficient extraction of information from images, PDFs, and other document formats, improving the overall invoice processing automation.

What more AI-powered RPA bot can do?

The AI-powered RPA bot can manage the entire invoice processing journey, encompassing tasks such as:

- Matching purchase orders

- Creating invoices

- Responding with instructions for check printing

This automation not only expedites the entire process but also eliminates the need for Accounts Payable controllers to meticulously review each step. The AP staff receives ready-to-initiate print receipts or notifications of exceptions that require their attention, streamlining the overall efficiency of the invoicing process.

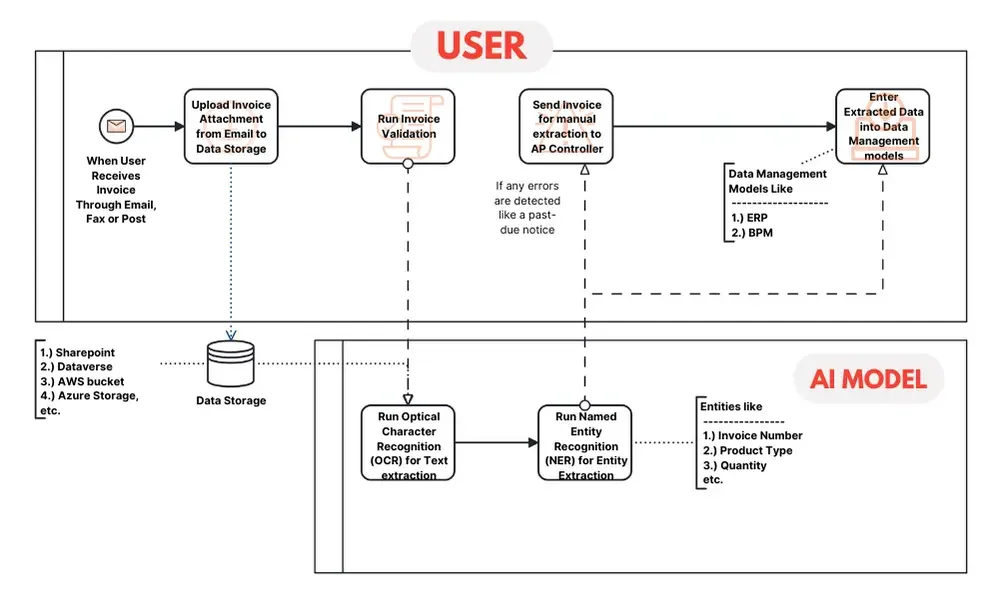

Here’s How It Works

- The software robot receives invoices as attachments in emails, using Power Automate it creates a folder with the present date, and then downloads all the invoices.

- The RPA bot then transfer these PDFs to ML model using OCR and NER technology it extract the text and decided entities (Invoice number, Vendor, etc.).

- If any errors are detected—like a past-due notice—the bot automatically sends an email to the business detailing the problem with the affected invoice attached.

- The bot then logs in to the Business Managemnet Software using secure credentials. It then creates the invoices using the extracted data.

- A summary report that includes the validated invoices and failed invoices is also sent automatically once the bot has finished its tasks.

Impact

Using Artificial Intelligence & Power Automate to streamline the invoice workflow significantly and positively impacts the task.

Show how much percent is impacted.

- Cost: 30-50% (Delloite)

- Time: 40-60% (McKinsey & Company)

- Accuracy: up to 99% (Aberdeen Group)

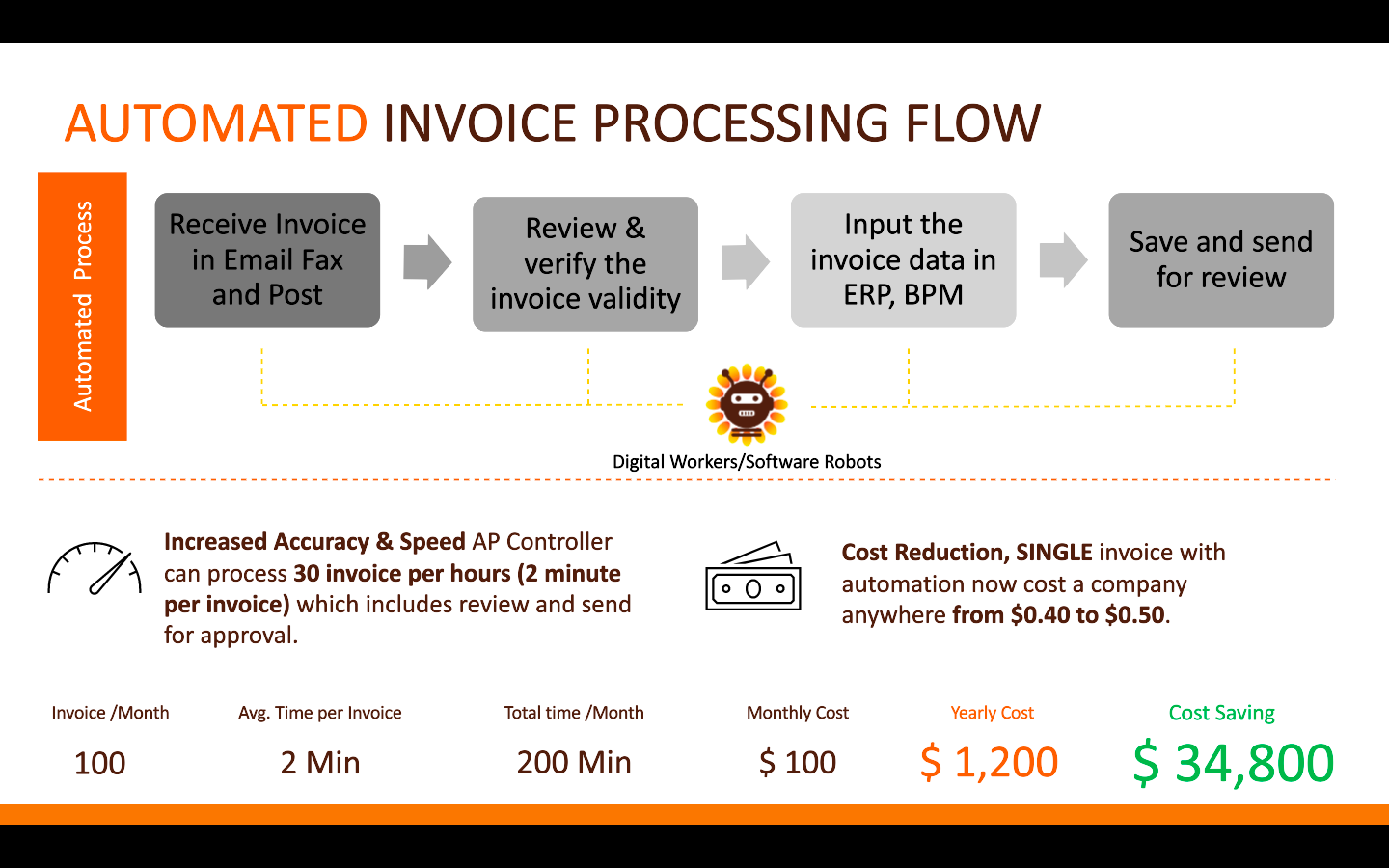

If we remove the knowledge workers from the typical invoice processing workflow above and replace them with digital workers/software bots, invoices can be completed in just 2 minutes at a cost of $0.40 to $0.50. And rather than spending $36,000 annually to manage invoices, the company will only spend $1,200 thanks to intelligent automation.

Why Power Automate for AP automation software?

Power Automate is a part of Microsoft’s Power Platform and it’s a robust tool designed to automate workflows across various applications and services. When it comes to Accounts Payable (AP) automation, Power Automate offers several benefits that make it an excellent choice for as it offers a customizable and scalable solution to meet your AP automation needs.

- Seamless Integration with Microsoft and Third-Party Applications

- Flexible Workflow Automation

- Scalability

- Real-Time Notifications and Alerts

- Cost-Reduction Solutions with pay-as-you-go model

- Security and Compliance

- Quick Implementation and Adoption

- Cost-Efficiency

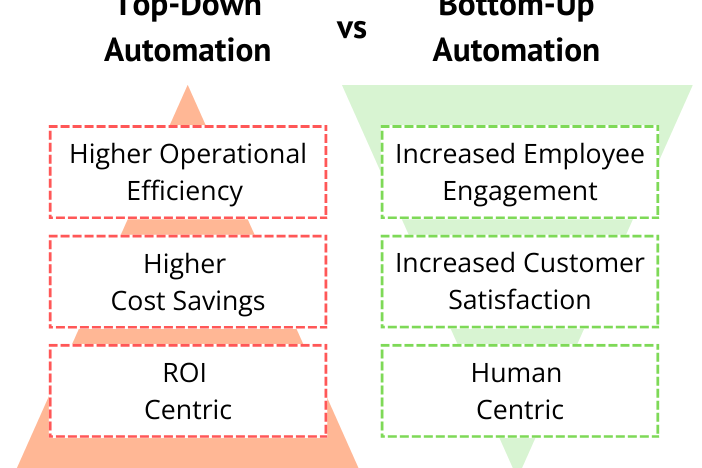

Why Does Your Business Need Account Payable Workflow Automation?

Businesses can benefit a lot if Account Payable Workflow is automated. As we all know the time taken and unscalability of human work, bots can be businesses best friends. This not only helps in cost-cutting but also allows employees to work on strategic tasks.

1) Time and Cost Savings

The company’s most precious resource is time, and spending it on monotonous, repetitive tasks can be both tedious and draining. Automation offers a solution, transforming tasks that might consume an entire day for an employee into a quick two-minute process handled by a bot. This not only rescues valuable time but also translates to significant cost savings.

2) Increased Accuracy

With less human intervention, the chances of manual errors decreases. Automation tools themselves cross verify each and everything. This protects from unnecessary delays and late payment charges.

3) Faster Approval Cycles

Automated workflows make it easier to approve things quickly by cutting down on the time it takes for manual approval steps. It also sends automatic reminders to make sure everyone stays on track, ensuring timely actions from the right people. This helps things move faster and keeps the process smooth.

4) Scalability

As your business grows, the automation system can adapt to handle higher transaction volumes seamlessly. This allows businesses to reap benefits in the same time and costs, without any added expense.

5) Data Insights for Decision-Making

Analytics tools can be integrated anywhere and everywhere to analyze spending patterns, identify opportunities for cost savings, and optimize financial processes. This helps in strong decision making and strategic planning for the future.

Conclusion

For decades, businesses have been invoicing the same, wasteful way. Now, RPA has arrived to disrupt the process for higher yields, greater savings, and more accuracy. Accounts payable teams no longer waste away toggling between applications, manually verifying data, and sending emails. These jobs are now replaced by robots, freeing up knowledge workers for more important jobs like tracking down payments from customers. A high-functioning workforce consists of robots and humans working together to achieve maximum efficiency and output.

Let’s together automate your business workflows so you can achieve your goals and focus on your customers better. Contact us today and our team will be happy to assist you.

Our Automation Solutions

You might also like

Stay ahead in tech with Sunflower Lab’s curated blogs, sorted by technology type. From AI to Digital Products, explore cutting-edge developments in our insightful, categorized collection. Dive in and stay informed about the ever-evolving digital landscape with Sunflower Lab.